For as often as you hear business people mention "focus groups," it's clear this qualitative research technique is sometimes used where it should be and used a LOT where it shouldn’t be.

For as often as you hear business people mention "focus groups," it's clear this qualitative research technique is sometimes used where it should be and used a LOT where it shouldn’t be.

I guess nobody ever said market research was clear cut!

We don't cover market research much since it's a more specialized area many of you don’t have in your responsibilities. Even if you're not managing focus groups or other qualitative research approaches, however, you may be asked to provide input into their use or design.

The importance of having a framework to understand when and how focus groups fit into your decision making process this was underscored while sitting through focus groups arranged by a consultant for one of our clients.These groups were designed and managed in very different and odd ways that weren't appropriate for the client's decision making process.

5 Ways to Not Screw Up Focus Group Input

If a focus group is suggested as part of your decision making process, here are five questions to make sure they will contribute valuable input:

1. Are you trying to expand your divergent thinking about whatever you’re testing?

Focus groups (or really any qualitative research) aren’t for decision making by themselves. That’s where projectable, quantitative research fits in your market research agenda. Go into focus groups expecting to have your perspectives expanded since they work better for divergent thinking more than convergent thinking. A focus group shouldn’t be used as a standalone market research technique for gaining the input to make a definitive decision.

2. Are you willing to incorporate varied types of market research input into your decision making?

Traditional focus groups tend to be very verbal experiences for participants. Non-talking participants’ perspectives will be missed unless you have a GREAT facilitator to force these people into the conversation. This is why you see more non-verbal elements in qualitative research now, including written exercises, collage creation, homework projects, show and tell with items from daily life, designing experiences, etc. If you’re uneasy about inputs extending beyond what focus group participants say about your market research topic, think carefully about conducting focus groups to expand your insights.

3. Are you talking to enough different types of people to provide a flavor of the market segments of greatest interest?

If you’re deciding on focus groups, conduct multiple ones to provide the diverse perspectives needed for rich divergent thinking. What you hear in talking to ten people in a focus group facility isn’t representative of a market. It simply tells you what those ten people think. If you’re after expanded perspectives, make sure you conduct enough focus groups. Enhancing your divergent thinking depends on doing more than one focus group per market segment. It takes multiple focus groups to experience a diverse range of perspectives and gain a sense of whether themes are emerging.

4. Are you ready to witness a lot of sameness in the pursuit of stronger divergent thinking?

One focus group is interesting. Six or eight focus groups can be deadly. While pursuing diverse insights, however, you can expect a lot of sameness: the same facilitator with the same number of participants, similar parts of the day for the focus groups, similar discussion structures, etc. Some facilitators even wear the same clothes for every session because different outfits create different focus group participant reactions. This is all intended to not introduce any non-related cues that might influence responses. When you’re in the backroom observing the focus groups, your boredom with the process shouldn’t lead to demands for dramatic format changes to keep you interested across the entire market research effort. When you want diverse perspectives, format sameness is part of the deal.

5. Are YOU expecting to make the decisions when the focus groups are completed?

While focus group participants may be decision makers in your marketplace, they aren’t decision makers in your organization for whatever you are researching. It’s YOUR decision to select a strategic course of action. Focus groups are just one element - one input - into your decision making. You may need to decide to do exactly the opposite of what focus group participants suggested. That’s okay, because decision making is your job. You have the full view of the strategic situation. Don’t expect to hand your decision making responsibilities over to focus group participants and think you can absolve yourself of having to make a solid strategic decision.

Is a focus group the right market research technique for your decision making?

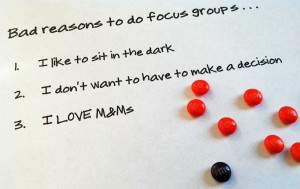

If it's not obvious by now, you should have answered "Yes" to each question if focus groups are being recommended to support your decision making process. Any inability to answer these questions affirmatively suggests you need more discussion or different expectations for focus groups to make sense for you . . . no matter how much you love the M&Ms you get in the back room at the focus group facility! - Mike Brown

If you enjoyed this article, subscribe to the free Brainzooming email updates.

The Brainzooming Group helps make smart organizations more successful by rapidly expanding their strategic options and creating innovative plans they can efficiently implement. Email us at info@brainzooming.com or call us at 816-509-5320 to learn how we can help you enhance your strategy and implementation efforts.